Market Commentary | December 2020

Rob Kellogg, CFA®

THE MARKET

The calendar year of 2020 has come to an end, so let us start by wishing everyone a Happy New Year!

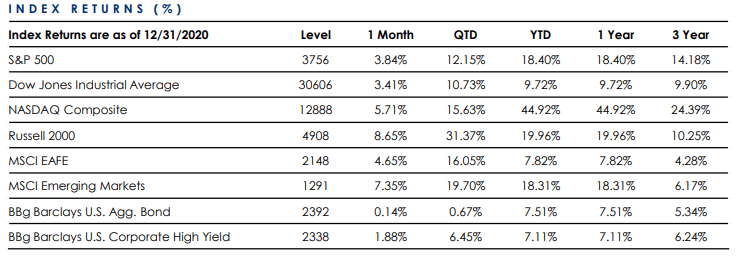

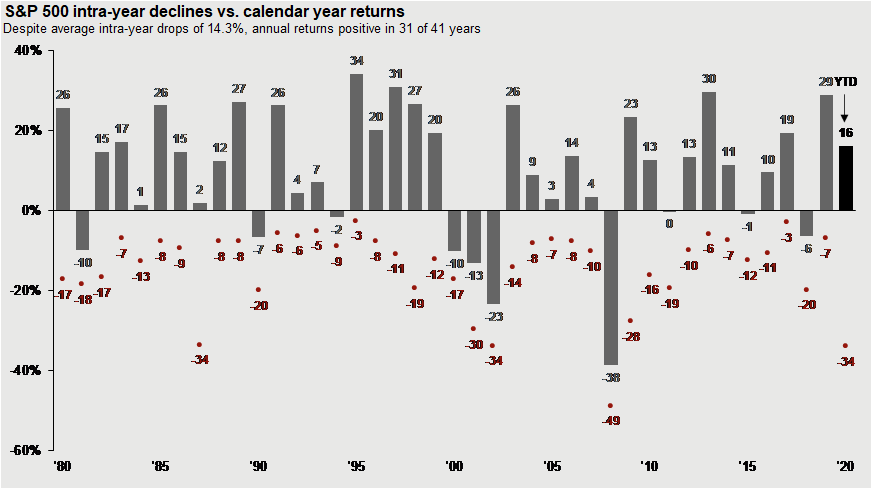

While the S&P 500 was down 34% at one point this year, the index finished the year up 18.40%. December helped the index finish the year off strong posting a gain of 3.84%. The Dow Jones Industrial Average (DJIA) finished the month up 3.41% and was nearly up double digits on the year at 9.72%. The technology heavy NASDAQ led the way in the new social distancing type of economy. The NASDAQ finished the year up 44.92% after increasing 5.71% in the month of December.2

While the year ended on a positive note for the markets, it was not without many bumps along the way. The image to the right shows the intra-year declines of the S&P 500 represented by the red dots. The gray/black bars showcase the final year end performance.

2020 RECAP

The year 2019 saw the market have its best performing year since 2013.2 It was also one of the least volatile years of the decade. One of the more frequent questions that we received to start 2020 was, “Why didn’t my portfolio keep up with the S&P 500?” The answer was simple. If you want to achieve higher returns, you must be willing to take on a larger amount of risk. It is imperative that you have the correct expectations for your portfolio moving forward. Conversations earlier in the year made it easier to explain the ebbs and flows of the year that followed. Fast forward three months and many investors were ecstatic that their portfolio didn’t fall the over 30% like the S&P 500. Fast forward nine more months and the S&P 500 finished the year up over 18%. It is very difficult to predict the short-term movements of the stock market, but what we can do is help to set expectations. Specifically, how a portfolio will react to given circumstances. By having a dynamic financial plan, we can take advantage of rebalancing during the large market swings to put ourselves in a better position moving forward.

A lot contributed to the large market movements and swings in 2020. So, we thought we’d briefly recap some things that feel like they occurred much longer than just a few months ago.

In January, we discussed the forthcoming Brexit at the end of the month, and geopolitical tensions between the United States and two nations. With China, we had the trade war. Phase One was ultimately signed in January. The month also saw heightened tensions between the United States and Iran with a U.S. drone strike killing an Iranian major general. The beginning of February saw those in the United States beginning to discuss Covid-19 and by the end of the month, the pandemic had begun. On Tuesday, March 3rd, the Fed decided to lower interest rates, the first emergency rate move since the depths of the Financial Crisis.4 March also saw the S&P 500 enter bear market territory as it fell 12.5% during the month.2 The pandemic was in full swing as nationwide lockdowns began.

COVID-19 PANDEMIC

We always say that it isn’t about timing the market, but it is about time in the market, and that rang true in April as the S&P 500 rebounded with its best month since 1987.6 The index finished April up 12.7%. While the market rebounded, the economy was just beginning its downward trajectory. March saw the first large stimulus packaged being passed by the government and April saw $1,200 checks being issued to Americans under the income threshold.7 The rest of April and most of May seemed like a blur to most as the country was on lockdown. Cases began to rise, mask mandates were the norm, and many small businesses were beginning to close their doors. The death of George Floyd occurred at the end of May resulting in many protests and national discussions on racial injustice.8

July marked the return of both the NBA, in the bubble, and the MLB. Both of which provided a springboard for many other sports to follow. Economic activity such as travel and dining out began to rise.9 In August and September, many students returned to school and football kicked into gear, however, both looked different with online learning and mostly empty stadiums. Covid-19 cases began to rise in October and November before coming to a head surrounding Thanksgiving travel. We saw the first real results of vaccine effectiveness in November, and by December the vaccine was being issued to American citizens.10 The end of 2020 saw a rise in equity prices as investors seemingly looked past the rise in virus cases and towards news of a stimulus package from the government.

On Sunday, December 27th, 2020, President Trump signed a $900 billion dollar relief package for the pandemic and a $1.4 billion dollar government relief bill. Closing out the year, Monday the 28th saw the house pass a bill that would increase the recent stimulus check to Americans up to $2,000 from original amount of $600, however, the Senate did not pass the bill.12 Talks will continue in early 2021.

THE ELECTION

As we discuss the political divide regarding the most recent stimulus package, it is important for us to remember that the elections of 2020 aren’t yet over. There are still calls for voter fraud from President Trump, but it is seeming more and more likely that the President Elect Biden will be confirmed. Without too long of an explanation, lawmakers can object to a state’s electors if at least one representative from the House and one from the Senate decide to do so. If that occurs, the House and Senate split to vote on the objection and will have two hours to debate each state. The House will have the votes to defeat all challenges as it is controlled by Democrats. The Senate is controlled by Republicans, but they do not all agree on the matter as even Senate Majority Leader Mitch McConnel (R-Ky.) has asked he fellow Senators not to challenge. It is expected for the Senate to confirm Biden’s win as well.13

The election that is still ongoing and will have repercussions into the future happens in Georgia on Tuesday, January 5th. As of result of Republican Senator Johnny Isakson’s retirement in 2019, both Senate seats in Georgia were on the 2020 ballot. Kelly Loeffler was appointed to take over Isakson’s seat after his retirement, however, she still needed to win in the November election to maintain the seat. Georgia requires candidates to capture at least 50% of the vote to be declared winner. Neither Republican incumbent did so in the November election though each earned more than their Democratic competition. Current Senator David Perdue is facing off against Democratic nominee Jon Ossoff while current Senator Loeffler is running against Reverend Raphael Warnock.14 After the November election, Republicans held the majority in the Senate by a 50 to 48 margin. If they win one seat in Georgia, they will maintain the majority, but if both seats are won by the Democrats, we will have split Senate of 50-50. When votes in the Senate end in a tie, the Vice President casts the deciding vote which will be Democrat Kamala Harris for the next four years.

There is a lot at stake in Georgia as our country will look markedly different with a Democratic controlled Senate for the next four years. We aren’t here to pick sides, but things like potential controversial cabinet appointees and control of Congress sub-committees will have a different result depending on Georgia’s outcome. This will hinder the Republicans ability in Congress. Many regulations passed by the Trump Administration are also likely to be repealed if the Democrats control the Senate. Even though the Republicans have narrowed the gap in the House, losing control of the Senate will likely lead to more of the Biden Administration’s agenda being completed in the next four years. Results are not official yet although it appears that the Democrats have won both seats.21 We will cover this more in next month’s commentary.

THE VIRUS

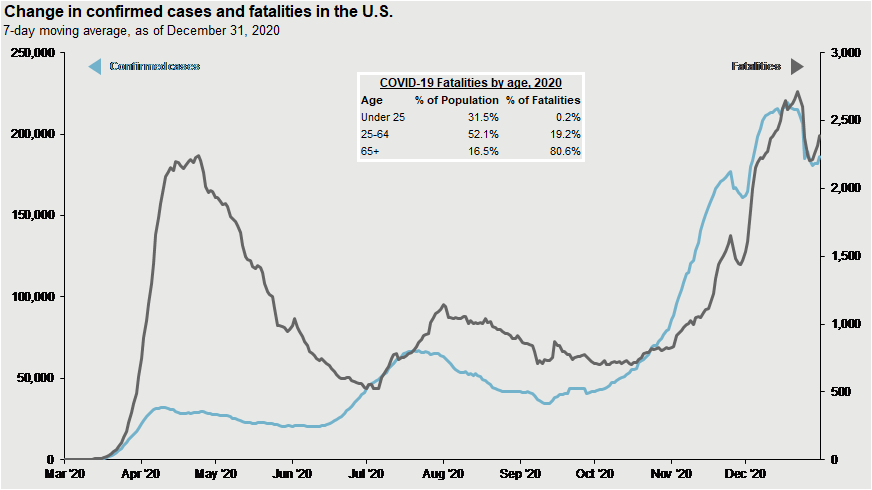

Covid-19 is still very much a threat to the economy as we enter the new year. In the end of December, the country’s leading infectious disease expert, Anthony Fauci, stated that the worst may be yet to come.16 And on January 2nd, 2021, the United States experience its highest number of cases in a single day.17 In the image to the right (Source 18), you can see that cases and deaths both began to plateau in the summer months, but that November and December saw quite the spike.

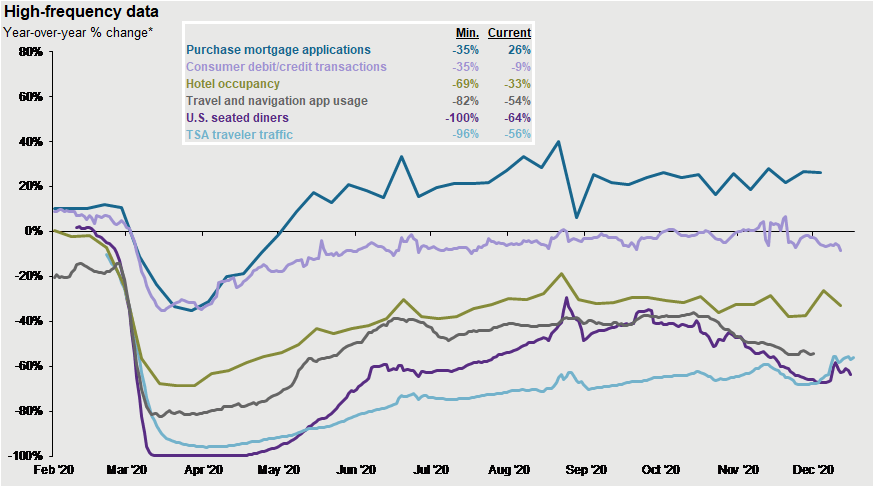

The good news is that the FDA has approved two vaccines for distribution, but the bad news is that these have not been administered as quickly as hoped. Officials are hopeful to be back on track in the near future.19 With cases continuing to rise, the hope is that the vaccine will curb the increase as we get through the first quarter of 2021. What is promising for investors, and as we’ve discussed throughout the year, is that we have slowly started to adapt to a social distancing type of economy. The image to the right (Source 9) shows the large decrease in economic activity at the start of the pandemic followed by a steady rise of activity in the summer months. As you can see, activity has somewhat plateaued and did not see a drastic decrease over the last two months with the rise in cases. This is promising news to show that we are figuring out how to keep the economy afloat and can continue to keep the economy open to an extent so long as we adhere to social distancing measures and certain protocols.

BREXIT

As virus cases increase in the United States, the virus is continuing to get worse in the United Kingdom as well. Even the virus could not stop Brexit from becoming official though. The United Kingdom (U.K.) officially left the European Union (EU) on January 31st of 2020, but they were stuck in an 11-month limbo under the EU trading rules as the two sides negotiated. The two sides agreed to a new deal on December 24th, 2020, and as the year 2020 came to an end, the United Kingdom was officially an independent nation once again. Some major changes that are now in effect:

- The free movement of people between the UK and EU countries has ended - and has been replaced in the UK by a "points-based" immigration system

- Anyone from the UK who wants to stay in most of the EU for more than 90 days in any 180-day period now needs a visa

- Duty-free shopping has returned, with people coming back to the UK from the EU able to bring up to 42 litres of beer, 18 litres of wine, four litres of spirits and 200 cigarettes without paying tax

- EU citizens wanting to move to the UK (except those from Ireland) face the same points-based system as people elsewhere in the world

- UK police have lost instant access to EU-wide databases on criminal records, fingerprints and wanted persons.20

CONCLUSION

While the page has flipped to 2021, it is important that we remember 2020 and not forget it. There were a lot of experiences in 2020 that shaped our current environment and just because they year is over; it does not mean that the issues have passed. There will still be political tension, race issues, differing opinions regarding Covid-19 and its vaccine, and many new issues that arise in 2021. We don’t wish to frighten you or to rial anyone up, but we want to bring to light the fact that we experienced them, we survived them, and there will be more of them in the coming year. Adhering to a disciplined investment approach that took the emotion out of investing allowed portfolios to ride the ebbs and flows of the market volatility in 2020. It is important to continue that approach in 2021 as volatility is likely to continue in today’s headline driven society. Money earmarked for the long term should be invested to handle the market movements, and money needed for the short term should be allocated to cash-like investments that are not exposed to immediate market risk. It is important that our portfolios have the correct asset allocations based on our risk tolerances as 2021 moves full steam ahead. We encourage you to reach out in order to make sure that your investments align with not only your ability to take risk, but also with your appetite for risk. Having a dynamic financial plan in place helps withstand market volatility, meet short term needs, and also allocates longer-term assets to have the best chance of achieving long term goals.

1 https://www.massmutual.com/mmfunds/monthly_market_overview.pdf

2 https://www.investing.com/indices/

3 FactSet, Standard & Poor’s, J.P. Morgan Asset Management. Returns are based on price index only and do not include dividends. Intra-year drops refers to the largest market drops from a peak to a trough during the year. For illustrative purposes only. Returns shown are calendar year returns from 1980 to 2020, over which time period the average annual return was 9.0%. J.P Morgan - Guide to the Markets – U.S. Data are as of December 31, 2020.

4 https://www.nytimes.com/2020/03/03/business/economy/fed-interest-rates-coronavirus.html

5 https://www.europol.europa.eu/activities-services/staying-safe-during-covid-19-what-you-need-to-know

7 https://www.cnbc.com/2020/04/13/first-coronavirus-stimulus-checks-deposited.html

8 https://www.nbcnews.com/george-floyd-death

9 Source: App Annie, Chase, Mortgage Bankers Association (MBA), OpenTable, STR, Transportation Security Administration (TSA), J.P. Morgan Asset Management. *Consumer debit/credit transactions, U.S. seated diners, and TSA traveler traffic are 7-day moving averages. App Annie data is compared to 2019 average and includes over 600 travel and navigation apps globally, including Google Maps, Uber, Airbnb and Booking.com. Consumer spending: This report uses rigorous security protocols for selected data sourced from Chase credit and debit card transactions to ensure all information is kept confidential and secure. All selected data is highly aggregated and all unique identifiable information—including names, account numbers, addresses, dates of birth, and Social Security Numbers—is removed from the data before the report’s author receives it. J.P Morgan - Guide to the Markets – U.S. Data are as of December 31, 2020.

10 https://www.washingtonpost.com/nation/2020/12/14/first-covid-vaccines-new-york/

12 https://www.ftportfolios.com/Commentary/MarketCommentary/2021/1/4/week-ended-december-31,-2020

13 https://www.washingtonpost.com/politics/2021/01/04/congress-presidential-election-january-6/

14 https://www.nytimes.com/2021/01/05/us/politics/georgia-senate-election-runoff-guide.html

17 https://www.statista.com/statistics/1103185/cumulative-coronavirus-covid19-cases-number-us-by-day/

18 Source: Centers for Disease Control and Prevention, Johns Hopkins CSSE, J.P. Morgan Asset Management. J.P Morgan - Guide to the Markets – U.S. Data are as of December 31, 2020.

20 https://www.bbc.com/news/uk-politics-55502781

21

https://www.cnn.com/2021/01/05/politics/loeffler-ossoff-perdue-warnock-runoff-results/index.html

Returns are based on the S&P 500 Total Return Index, an unmanaged, capitalization-weighted index that measures the performance of 500 large capitalization domestic stocks representing all major industries. Indices do not include fees or operating expenses and are not available for actual investment. The hypothetical performance calculations are shown for illustrative purposes only and are not meant to be representative of actual results while investing over the time periods shown. The hypothetical performance calculations for the respective strategies are shown gross of fees. If fees were included returns would be lower. Hypothetical performance returns reflect the reinvestment of all dividends. The hypothetical performance results have certain inherent limitations. Unlike an actual performance record, they do not reflect actual trading, liquidity constraints, fees and other costs. Also, since the trades have not actually been executed, the results may have under- or overcompensated for the impact of certain market factors such as lack of liquidity. Simulated trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. Returns will fluctuate and an investment upon redemption may be worth more or less than its original value. Past performance is not indicative of future returns. An individual cannot invest directly in an index.

This material has been prepared for information and educational purposes and should not be construed as a solicitation for the purchase or sell of any investment. The content is developed from sources believed to be reliable. This information is not intended to be investment, legal or tax advice. Investing involves risk, including the loss of principal. No investment strategy can guarantee a profit or protect against loss in a period of declining values. Investment advisory services offered by duly registered individuals on behalf of ChangePath, LLC a Registered Investment Adviser.

Source (1)

Source (3)

"A lot contributed to the large market movements and swings in 2020. So, we thought we’d briefly recap some things that feel like they occurred much longer than just a few months ago."

Source (5)

Source (11)

"The Senate is controlled by Republicans, but they do not all agree on the matter as even Senate Majority Leader Mitch McConnel (R-Ky.) has asked he fellow Senators not to challenge."

Source (15)

Source (18)

Source (9)

"Anyone from the UK who wants to stay in most of the EU for more than 90 days in any 180-day period now needs a visa."