Market Commentary | November 2021

November was a dizzying month for investors.

- The highlight? Earnings. 82% of companies1 beat estimates this quarter, despite headwinds such as supply chain constraints and inflation.

- The market’s biggest muse? Elon Musk’s twitter handle, with tweets such as (paraphrased) “should I sell 10% of my Tesla stock?”

- The most exciting job? Fed watcher. We started tapering, saw a plethora of hot inflation data, and gleaned insight from Federal Reserve Chair Jerome Powell on the last day of the month.

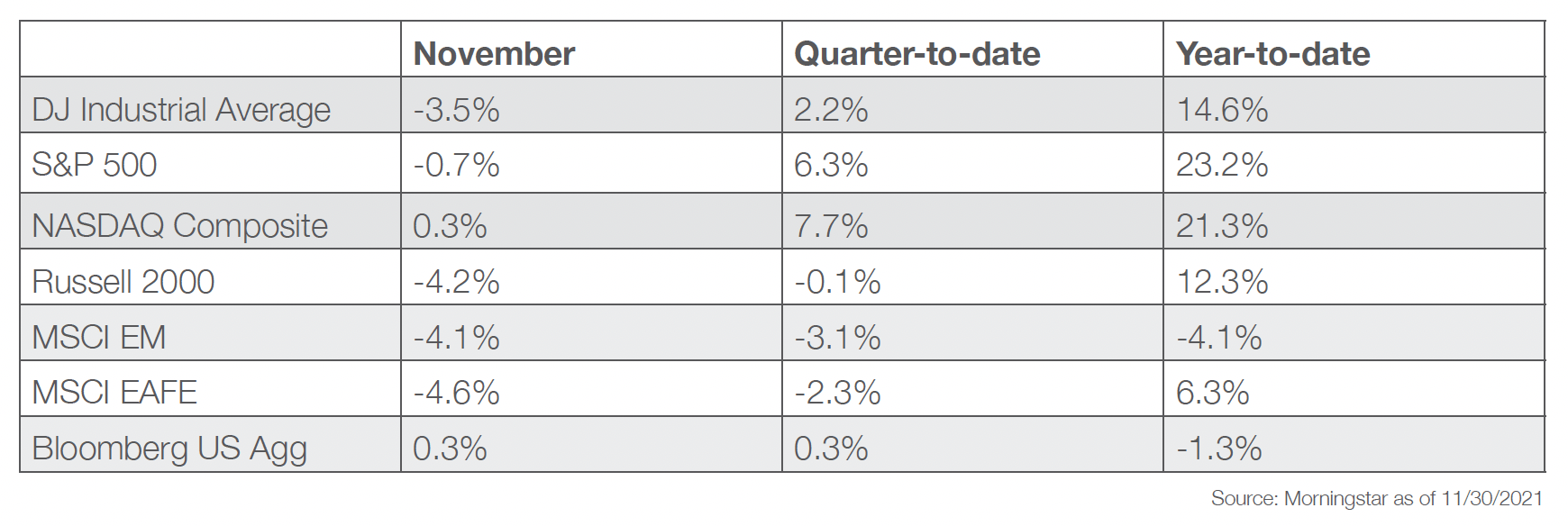

November 2021 Market Returns

Markets

The month started off on a high note. Equity markets were hitting new records and we were contemplating Elon Musk’s tweets daily. The Dow Jones Industrial Average index hit 36000 intraday for the first time ever. We had the official start of tapering (more on that later…), earnings started coming in strong, and it felt like markets were firing on all cylinders.

But that was just week one. Going into the second week of November, we saw hot inflation prints, continued supply constraints, hacks, and scams (cue Robinhood data security incident1 and SQUID cryptocurrency), and the market started to wobble from uncertainty. From then on returns were a mixed bag. Instead of the Dow Jones, S&P 500 and Nasdaq Composite indices all rising and falling together, the story became one of dispersion. Broadly, growth names in technology and consumer discretionary sectors outperformed value-oriented names in financials, energy, and industrials sectors. But there were also days when those trends reversed completely, keeping us on our toes.

Throughout the volatility, a lot of positive things happened. President Biden signed the $1 trillion infrastructure bill, Adele dropped a new album, and earnings continued to deliver despite supply constraints and inflation. In fact, by November 19, of the 95% of S&P 500 companies that had reported results, 82% of those companies reported a positive EPS surprise and 75% of those companies reported a positive revenue surprise.2

Investors sat at the Thanksgiving table breathing a sigh of relief.

But alas, we all know how this story ends. From Black Friday on, markets whipsawed as COVID-19 variant Omicron was dubbed a “variant of concern”, Moderna’s chief executive said he was skeptical that existing vaccines would be as effective against the new variant, and Jerome Powell came out with some strong commentary on the very last trading day of the month (more on this below). Net, net, the Dow Jones Industrial Average index ended the month down 3.5%, the S&P 500 was down 0.7% and Nasdaq Composite eked out a positive 0.3%.

The Fed and the Economy

November was a great month to be a Fed watcher.

On November 3rd, the Fed announced its plans to officially start tapering, i.e., reduce the pace of asset purchases, by $15 billion per month beginning mid-November. This brings monthly purchases from $120 billion to $105 billion.

Of course, as dutiful Fed watchers, we must also watch what the Fed is watching: inflation and employment.

- Inflation: Numbers continued to come in strong, hitting a three-decade high on supply shortages and high consumer demand in October. A BofA survey of fund managers3 published mid-November showed that inflation was the top risk for investors.

- Employment: Mid-month, the “quits rate” (the percentage of workers leaving their job vs. overall employment) hit a record high of 3% as 4.4 million workers quit their jobs in September. Near the end of the month, we saw the lowest jobless claims since 1969… for context, the year that “Sugar, Sugar” by the Archies was number one on Billboard’s Top Hot 100 songs.

Finally, on November 30, Federal Reserve Chairman Jerome Powell said that the risk of higher inflation has increased, and that elevated inflation pressures and rapid improvements in the labor market would justify “wrapping up the taper, perhaps a few months sooner.”

Let’s just say markets did not like this rhetoric.

Your Next Move

It is undeniable that there is uncertainty heading into the final month of the year, but don’t let the market’s inevitable ups and downs derail you from reaching your goals.

We continue to recommend a globally diversified approach depending on your goals, time horizon, and risk tolerance. History has proven the value of staying the course: a portfolio of 60% stocks and 40% bonds that remained invested has not suffered a negative return over any five-year rolling period in the last 70 years.4

December is a great time to reevaluate your goals and consider finalizing a plan for gifting and tax considerations before the close of the calendar year. Please reach out to have a conversation today.

Our next commentary will be in the New Year, so we wish you a Happy Holiday!

[1] FactSet. November 19, 2021. https://www.factset.com/hubfs/Website/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_111921A.pdf

[2] https://blog.robinhood.com/news/2021/11/8/data-security-incident

[3] Bank of America’s November 2021 Global Fund Survey. November 16, 2012. https://www.pionline.com/money-management/fund-managers-more-optimistic-global-growth-bofa-survey

[4] JPMorgan Asset Management as of December 31, 2020. 7 Principles of Long-Term Investing. Returns are based on calendar year returns from 1950 to 2020. Stocks are represented by the S&P 500 Shiller Composite and Bonds are represented by Strategas/Ibbotson for periods from 1950 to 2010 and Bloomberg Barclays Aggregate thereafter.

This commentary is published by ChangePath, LLC and is provided free of charge for information and education purposes and should not be construed as a solicitation for the sale or an offer to buy any security. This information is not intended to be investment, legal or tax advice. The information presented was obtained from sources and data considered to be reliable, but its accuracy and completeness is not guaranteed. It should not be used as a primary basis for making investment decisions. Any stated or implied recommendations herein are of a general nature. Clients should consult with their investment advisor representative for advice concerning their particular situations and consider their own financial circumstances and goals carefully before investing. This commentary is designed to be general in nature and reflects our overall opinion. Certain sections of this commentary contain forward-looking statements that are based on our reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not indicators or guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. Opinions, beliefs and/or thoughts are as of the date given and are subject to change without notice. Past performance is not indicative of future returns and there is always a risk of loss of principal with any investment strategy. Individuals cannot invest directly in an Index. Indices are unmanaged and do not reflect actual portfolios or trading and the stated returns do not include investment management fees, transaction fees, dividends and other earnings and the timing of investment decisions, thus, they are not necessarily indicative of the allocation or return that an actual managed account in the future will or would have achieved. Investment advisory services offered by duly registered individuals on behalf of ChangePath, LLC a Registered Investment Adviser.