Market Commentary | April 2021

Rob Kellogg, CFA®

THE MARKET

Equities fell on the last trading day of April as investors likely took their share of profits after positive news regarding corporate earnings and economic data. However, the major U.S. indices still finished in positive territory for the third straight month as the S&P 500 has hit 25 record highs thus far in 2021.1

| Index Returns (as of 4/30/2021) | Level | April/QTD | YTD |

|---|---|---|---|

| S&P 500 | 4181.17 | 5.24% | 11.32% |

| Dow Jones Industrial Average | 33879 | 2.72% | 10.69% |

| NASDAQ Composite | 13962.68 | 5.40 % | 8.34% |

| Russell 2000 | 2265.36 | 2.02 % | 14.71% |

| MSCI EAFE | 2268.51 | 2.73% | 5.63% |

| MSCI Emerging Markets | 1347.61 | 2.37% | 4.36% |

| U.S. Aggregate Bond | - | 0.79 | -2.61% |

Source (1)

The S&P 500 Index and the NASDAQ Composite both finished the month up by over 5%. The technology heavy NASDAQ led the way finishing the month up 5.40% and is now up 8.34% on the year. The S&P 500 is now up 11.32% on the year after posting a gain of 5.24% in April. The Dow Jones Industrial Average (DJIA) is now up double digits for the year at 10.69% after finishing up 2.72% during the month. Small cap equities continue to lead the charge in the United States as the Russell 2000 Index is now up nearly 15% on the year after finishing with a 2.02% gain in April. The MSCI EAFE and MSCI Emerging Markets Indices continue to show the importance of having a globally diversified portfolio as they both posted gains over 2% and are now up over 5% and 4% respectively. Fixed income had its first positive month of the year as the Bloomberg Barclay’s U.S. Aggregate Bond index finished the month up 0.79%, but it is still down 2.61% on the year.1

THE ECONOMY

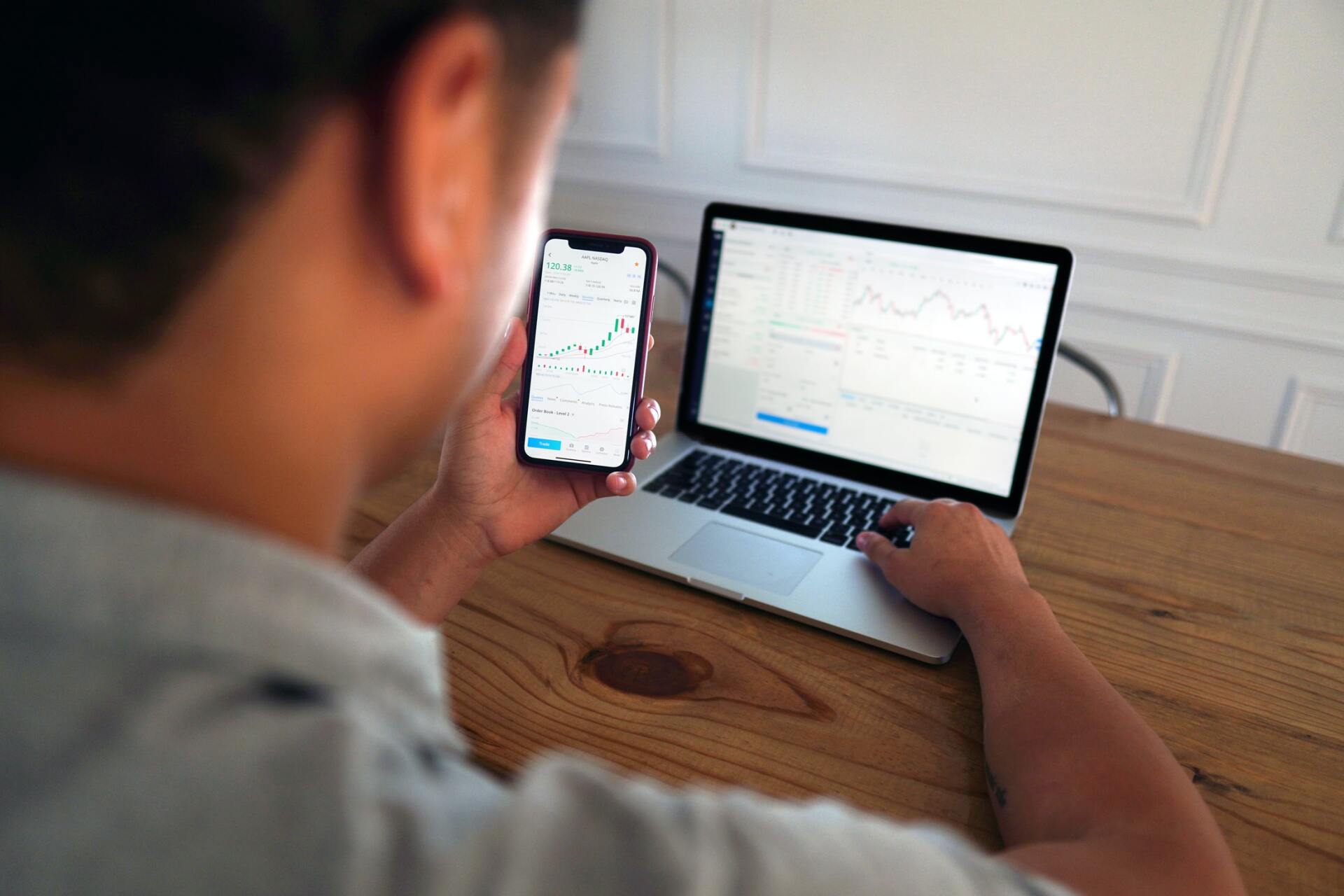

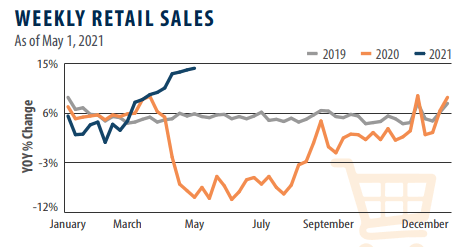

For much of the last year, the United States economy has been dictated by the coronavirus. Cases and fatalities continue to steadily decline, and experts expect a steep drop in both by July through vaccinations and the continued practice of wearing masks and social distancing.2 As of March 31st, 29.18% of adults in the United States had received at least one dose of the Covid-19 vaccine. That number increased to 43.32% by the end of April.3 States are beginning to ease their restrictions and the economy is recovering more quickly than expected. New York Governor Andrew Cuomo announced that New York State will have a major reopening on May 19th as many capacity restrictions will be lifted.4 While other states have already lifted restrictions and removed mask mandates, it is a significant step in the right direction for our country regarding New York as it was one of the hardest hit areas from the pandemic. As more states continue to reopen in stages, the economic data continues to be positive. First quarter GDP was expected to be 6% as of March 30th, but new estimates are coming in higher at 6.4% as relief checks drove consumer spending.5 As you can see in the first image, weekly retail sales are now significantly above 2019 and 2020 levels. Jobless claims continue to decline at a steady pace. They have not quite reached 2019 levels, but the difference year over year from 2020 to 2021 is significant.

Source (6)

Not only has the economic data been positive, but so too have company’s earnings estimates. As of April 30th, the first quarter earnings season has seen a record 87% of S&P 500 companies top estimates with earnings growth on average of 46%. Economic reports to watch in the coming days include updates on ISM manufacturing, construction spending, factory spending, and the March jobs report on Friday, May 7th.7

Along with the virus, our government’s response has also played a crucial role in our economy. Earlier this year, President Joe Biden signed the American Rescue Plan that put the third stimulus check in the pockets of many Americans. Since then, Biden has proposed two more plans aimed at creating jobs and reducing poverty as we come out on the other side of the pandemic. The first is the American Jobs Plan, that if approved, would put more than $2 trillion into the economy with the bulk of the plan focused on critical infrastructure. As outlined in Biden’s speech on April 28th, next up is the American Families Plan that will potentially set aside another $1 trillion for individuals and families while providing $500 billion in new tax credits.8 As of now, nothing has been passed, and it is likely that trimmed down versions will make it through Congress to the President’s desk. The plans will have an immediate positive impact on many Americans while others may feel the burden through taxes down the line.

Source (9)

For the better part of the last year, the Federal Reserve has been ready and willing to do what it takes by building a bridge for the economy over the pandemic. On Wednesday, April 28th, Fed Chair Jerome Powell reiterated that sentiment and said that it was too early to consider rolling back the Fed’s emergency support with so many workers still left jobless by the pandemic.10 However, on April 30th, Dallas Federal Reserve Bank President, Robert Kaplan, called for beginning the conversation about reducing central bank support for the economy, warning of imbalances in financial markets and arguing the economy is healing faster than expected.11 While there has been speculation of the Fed potentially tapering back bond purchases in early 2022 or even towards the end of 2021, the comment by Kaplan is the first real sign of it being a possibility. When the Fed purchases government bonds, bond prices increase and subsequently interest rates decrease. The purchases combined with keeping the target Federal Funds rate low result in easier financial conditions to bolster the economic recovery. The economy has not yet reached the Fed’s goal of full employment and 2% inflation, but it is an ongoing situation to monitor as the tapering of bond purchase will allow interest rates to rise which could hinder equities and reduced spending may cause earnings to fall.

CONCLUSION

We maintain a positive outlook for equities over the course of the year as the economy continues to recover. Equity valuations are seen as relatively high, but they are supported by current low interest rates. Still, there are real concerns on the horizon in 2022 as future tax increases and the Fed’s ongoing response could alter equity markets. Regarding bonds, potential inflation will erode purchasing power and will typically have a negative impact on a fixed income portfolio. While the market will go up over time, it does not go up in a straight line, and we do expect bouts of volatility for the remainder of 2020. With today’s news cycle, the volatility can come quickly, but even in our current bull market, corrections are seen as sign of a healthy markets. Thus, it is important to maintain a disciplined approach, but also a well-diversified one. The current environment for fixed income may not seem attractive as the Bloomberg Barclay’s U.S. Aggregate Bond Index is down almost 3% on the year.1 Rising yields lead to falling bond prices, and the 10-year treasury yield has increased by over one percent from 0.64% in April of 2020 to 1.65% in April of 2021.12 It may even seem like you are missing out on returns by not placing more of your money in the stock market as the major equity indices continue to climb month after month and fixed income remains negative. But there are known concerns for the equity market as mentioned above, and there are also unforeseen events like the pandemic that can have unknown affects on your investment portfolios. While bonds may seem unattractive in our current environment, it is important to have the correct allocation to fixed income based on your risk tolerance to protect your portfolio through the volatility. If you’d like to revisit your current asset allocation or your risk tolerance, don’t hesitate to reach out for a review of your financial plan.

1 https://www.investing.com/indices/major-indices

3 https://ourworldindata.org/covid-vaccinations

4 https://www.wivb.com/news/new-york/watch-governor-cuomo-gives-covid-19-update-from-nyc/

5 https://www.bea.gov/news/2021/gross-domestic-product-first-quarter-2021-advance-estimate

7 https://seekingalpha.com/article/4423506-wall-street-breakfast-week-ahead

9 https://www.omfif.org/policy-tracker-fed/

12

https://www.treasury.gov/resource-center/data-chart-center/interest-rates/pages/textview.aspx?data=yield

Returns are based on the S&P 500 Total Return Index, an unmanaged, capitalization-weighted index that measures the performance of 500 large capitalization domestic stocks representing all major industries. Indices do not include fees or operating expenses and are not available for actual investment. The hypothetical performance calculations are shown for illustrative purposes only and are not meant to be representative of actual results while investing over the time periods shown. The hypothetical performance calculations for the respective strategies are shown gross of fees. If fees were included returns would be lower. Hypothetical performance returns reflect the reinvestment of all dividends. The hypothetical performance results have certain inherent limitations. Unlike an actual performance record, they do not reflect actual trading, liquidity constraints, fees and other costs. Also, since the trades have not actually been executed, the results may have under- or overcompensated for the impact of certain market factors such as lack of liquidity. Simulated trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. Returns will fluctuate and an investment upon redemption may be worth more or less than its original value. Past performance is not indicative of future returns. An individual cannot invest directly in an index.

This material has been prepared for information and educational purposes and should not be construed as a solicitation for the purchase or sell of any investment. The content is developed from sources believed to be reliable. This information is not intended to be investment, legal or tax advice. Investing involves risk, including the loss of principal. No investment strategy can guarantee a profit or protect against loss in a period of declining values. Investment advisory services offered by duly registered individuals on behalf of ChangePath, LLC a Registered Investment Adviser.