Market Commentary | January 2021

Rob Kellogg, CFA®

THE MARKET

After a strong start to the year, the S&P 500 fell just over 3% during the final week of January causing the index to finish the month down 1.11%.

The Dow Jones Industrial Average (DJIA) followed suit and ended the month down 2.04% after also falling over 3% in the final week.1 It was a tale of two halves to begin the year as the markets initially reflected optimism regarding a new stimulus package from the Biden Administration and positivity regarding the vaccine roll out. The optimism was curbed as retail investors sparked unforeseen volatility in the equity markets causing a slight de-risking in portfolios during the last week of the month.

The technology heavy NASDAQ Composite continued to outperform relative to the S&P 500 and DJIA finishing the month up 1.42%. Small-cap stocks led equity markets in the United States as the Russell 2000 finished the month up 5.00%. Emerging markets also outperformed to start the year as the MSCI EM Index finished the month up 2.97% led by strong performance from China.1

THE ECONOMY

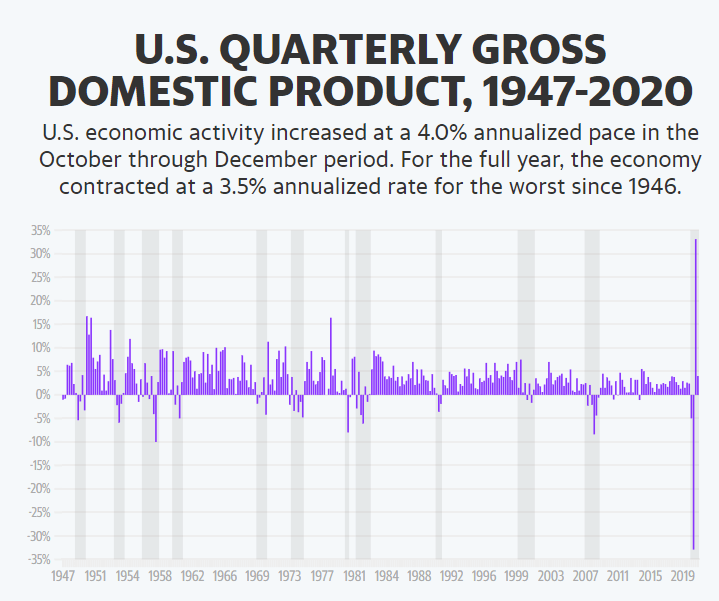

The United States’ economy continued to recover in the fourth quarter, but at a slower rate. After the record surge in the third quarter that saw GDP rise 33.4% on an annualized basis (a reflection of the drastic drop in the second quarter), fourth quarter estimates show a modest 4.0% annualized increase. The slowdown was a bit more than expected as the Covid-19 pandemic worsened towards the end of the year. Overall, U.S. GDP fell 3.5% annualized in 2020 which marks the first contraction since 2009 and the largest decrease since 1946.2

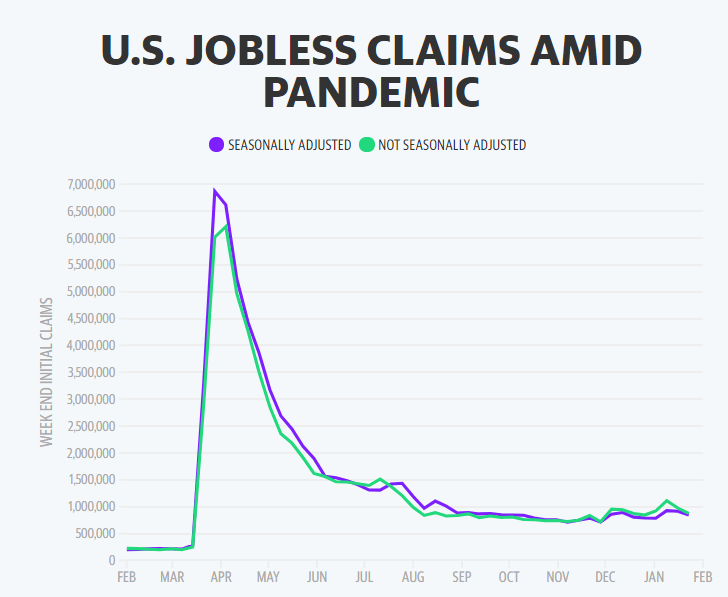

As new coronavirus infections hindered growth in the fourth quarter, it also led to a 140,000 decrease in non-farm payroll jobs for the month of December which was much lower than the expected increase of 50,000.4 This led to a slight increase in initial jobless claims in January as 847,000 new claims were filed for the week ending on January 23rd. For reference, weekly jobless claims were closer to 200,000 prior to the pandemic.5 As the non-farm payroll jobs decreased and the pandemic worsened to end the year, personal consumption finished lower than expected at a 2.5% increase.6 All in all, the economy is healing, just slightly slower than expected.

The month of January started with great political tension as the Georgia Senate run-off was held on January 5th followed by the Capitol Hill riots the next day as Congress met to certify the Presidential Election. Ultimately, the Democrats emerged victorious in both Georgia Senate races to take control of the Senate (the Senate is now split 50/50 with Vice President Kamala Harris holding the tiebreaking vote). The Presidential Election was eventually certified late in the evening on January 6th and President Joe Biden took office on January 20th. He began his term in office with numerous executive orders that will greatly impact our country moving forward. While there is still a political divide in our country, we believe the political certainty provided during the month of January can be seen as a good thing for both the economy and markets.

Even with the economy growing at a slightly slower pace than expected in the fourth quarter, there is optimism moving forward as it relates to the vaccine, monetary policy, and fiscal policy. As of February 3rd, over 33 million Americans have received the Covid-19 vaccine whether it be from Moderna of Pfizer.7 There has also been positive news on the Johnson & Johnson single shot vaccine which should only help increase the speed of getting the vaccine to more Americans.8 The Biden Administration announced details of a $1.9 trillion-dollar Covid-19 relief plan titled the American Rescue Plan. This large amount is unlikely to be passed as it requires a 60-vote approval in the Senate meaning that 10 Republican Senators would have to agree to it. It’s possible the Democrats use a special reconciliation process to only require a simple majority to pass the bill.9 However, common ground may be found closer to the $1 trillion range considering Republicans countered Biden’s plan with a $618 million package.10 Lastly, the Federal Reserve stated that they will keep target interest rates at 0 – 0.25% through at least 2023 and will maintain their monthly bond purchases likely through the end of 2021 in order for the economic recovery to continue.11

CONCLUSION

The month of January seemed to be a continuation of 2020 with the political divide at the beginning the month and the retail investor frenzy to end the month, but there is an overall sense that we are getting closer to pre-virus norms. We believe equity markets should continue their momentum from the second half of 2020 supported by continued economic growth, improved earnings from companies affected by the pandemic, and support from both monetary and fiscal policy. We must continue to persevere through the pandemic as Covid-19 is still very much a risk with unknowns surrounding other strains. Thus, the recovery could continue to move along slower than expected. It is possible further stimulus is hindered by the 50/50 split in the Senate and we are still in a headline driven society that lends itself to market volatility. Because of this, we believe it is wise to continue to maintain a well-diversified balanced approach to investing based on your risk tolerance. The focus is still on quality in the United States, and as the global economic recovery continues, we believe that there are opportunities in international equities and all market caps in the United States as evidenced by the recent performance in small cap. If you’d like to revisit the holdings in your portfolio or update your risk tolerance and objectives in the New Year, don’t hesitate to reach out and schedule a meeting today.

1 https://www.investing.com/indices/major-indices

3 https://finance.yahoo.com/news/4q-gdp-2020-us-economy-coronavirus-pandemic-180133456.html

4 https://www.bls.gov/opub/ted/2021/payroll-employment-down-140000-in-december-2020.htm?view_full

5 https://finance.yahoo.com/news/initial-jobless-claims-for-week-ending-jan-23-001546390.html

6 https://www.thebalance.com/consumer-spending-trends-and-current-statistics-3305916

7 https://www.statista.com/statistics/1194931/covid-vaccine-doses-administered-by-state-us/

8 https://www.bbc.com/news/health-55857530

9 https://www.cbsnews.com/news/stimulus-covid-relief-democrats-1-9-trillion-plan/

10 https://www.forbes.com/advisor/personal-finance/gop-proposal-1000-stimulus-checks/

12

https://www.juliusbaer.com/es/insights/artificial-intelligence/the-robots-keep-coming-finance-gets-techier/

Returns are based on the S&P 500 Total Return Index, an unmanaged, capitalization-weighted index that measures the performance of 500 large capitalization domestic stocks representing all major industries. Indices do not include fees or operating expenses and are not available for actual investment. The hypothetical performance calculations are shown for illustrative purposes only and are not meant to be representative of actual results while investing over the time periods shown. The hypothetical performance calculations for the respective strategies are shown gross of fees. If fees were included returns would be lower. Hypothetical performance returns reflect the reinvestment of all dividends. The hypothetical performance results have certain inherent limitations. Unlike an actual performance record, they do not reflect actual trading, liquidity constraints, fees and other costs. Also, since the trades have not actually been executed, the results may have under- or overcompensated for the impact of certain market factors such as lack of liquidity. Simulated trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. Returns will fluctuate and an investment upon redemption may be worth more or less than its original value. Past performance is not indicative of future returns. An individual cannot invest directly in an index.

This material has been prepared for information and educational purposes and should not be construed as a solicitation for the purchase or sell of any investment. The content is developed from sources believed to be reliable. This information is not intended to be investment, legal or tax advice. Investing involves risk, including the loss of principal. No investment strategy can guarantee a profit or protect against loss in a period of declining values. Investment advisory services offered by duly registered individuals on behalf of ChangePath, LLC a Registered Investment Adviser.

| Level | MTD/QTD/YTD | |

|---|---|---|

| S&P 500 | 3,714.24 | -1.11 % |

| Dow Jones Industrial Average | 29,982.62 | -2.04% |

| NASDAQ Composite | 13,070.70 | 1.42% |

| Russell 2000 | 2,073.64 | 5.00 % |

| MSCI EAFE | 2,124.05 | -1.09% |

| MSCI Emerging Markets | 1,329.57 | 2.97% |

| U.S. Aggregate Bond | - | -0.72% |

Source (1)

Source – Bureau of Economic Analysis (3)

Source – U.S. Department of Labor (5)

Source (12)